Comparison of different ways to measure profitability in the Uruguayan agricultural sector through longitudinal clusters

DOI:

https://doi.org/10.31285/AGRO.27.1023Keywords:

longitudinal clusters, agricultural companies, profitability (ROA)Abstract

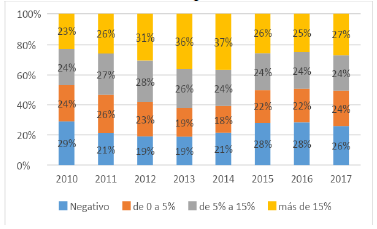

The use of ROA (Return on Assets) as a profitability indicator is widespread in financial literature; however, there is no agreement on the economic result to be used as a basis for calculation. In the agricultural sector, where financing and land costs are high, the problem takes on great relevance to interpret the economic reality of the farm companies. The study has two objectives: a) to discuss the relevance of using operating ROA —based on economic results without deducting financial and land leasing costs— and financial ROA —which does deduct them— in measuring the evolution of agricultural business profitability; and b) to verify if there are groups of companies that regardless of how their profitability is measured present clear similarities in their evolution. The theoretical framework supporting the use of these indicators is analyzed first, attempting to discern which aspects of profitability they attempt to measure. Then, the results of both indicators are compared in a dynamic analysis using longitudinal cluster methodology on a database composed of the Financial Statements of 713 Uruguayan agricultural companies in the 2010-2017 period. It is concluded, first of all, that there are no relevant differences in the way firms' profitability evolves, whether measured by operating or financial ROA. Secondly, the evidence shows that most firms can be classified into three groups where internal profitability has evolved similarly, regardless of how it is measured, two of them with notable differences in the rate of profitability and some differences in the speed of change of that rate.

Downloads

References

Álvarez J, Falcao O. Manual de gestión de empresas agropecuarias. Montevideo: Universidad de la República; 2009. 180p.

Arbeletche P. El agronegocio en Uruguay: su evolución y estrategias cambiantes en el siglo XXI. Rivar (Santiago). 2020;7(19):109-29.

Barney JB. Resource-based theories of competitive advantage: a ten-year retrospective on the resource-based view. J Manag. 2001;27(6):643-50.

Becker-Blease JR, Kaen FR, Etebari A, Baumann H. Employees, firm size and profitability of US Manufacturing Industries. Invest Manag Financ Innov. 2010;(7):119-32.

Bejar-León LM, Jijón-Gordillo ER. Medición de la rentabilidad para los accionistas: ¿Es el ROE un indicador confiable para evidenciar la rentabilidad de los accionistas? Polo del conoc. 2017;2(5):1354-61.

Castaño Duque GA. Teoría de la agencia y sus aplicaciones. Decisión Administrativa. 1999;(1):712.

Celeux G, Govaert G. A Classification EM algorithm for clustering and two stochastic versions. Comput Stat Data Anal. 1992;14(3):31532.

Chhibber PK, Majumdar SK. Foreign ownership and profitability: property rights, control, and the performance of firms in Indian industry. J Law Econ. 1999;42(1):209-38.

Dos Santos JGC, Calíope TS, Coelho AC. Teorias da Firma como fundamento para formulação de teorias contábeis. REPeC. 2015;9(1):101-16.

Espinosa FR, Molina ZAM, Vera-Colina MA. Fracaso empresarial de las pequeñas y medianas empresas (pymes) en Colombia. Suma de negocios. 2015;6(13):29-41.

Favaro Villegas D. Enfoques de la teoría de la firma y su vinculación con el cambio tecnológico y la innovación. Cult econ. 2013;31(85):50-70.

Fernández M, Gutiérrez F. Variables y modelos para la identificación y predicción del fracaso empresarial: revisión de la investigación empírica reciente. Rev Contab-Span Account Rev. 2012;15(1):7-58.

Fornero RA. EBITDA: la medida y el múltiplo. Cuyo: Universidad Nacional del Cuyo; 2019. 11p.

Fourati YM, Ghorbel RC, Jarboui A. Sticky cost behavior and its implication on accounting conservatism: a cross-country study. J Financ Report Account. 2020;18(1):169-97.

Galindo Lucas A. El tamaño empresarial como factor de diversidad [Internet]. [place unknown: publisher unknown]; 2000 [cited 2023 Mar 06]. 199p. Available from: http://www.eumed.net/libros/2005/agl3/index.htm.

Genolini C, Alacoque X, Sentenac M, Arnaud C. kml and kml3d: R Packages to Cluster Longitudinal Data. Journal of Statistical Software. 2015;65(4):1-34. Available from: http://www.jstatsoft.org/v65/i04/.

Genolini C, Falissard B, Pingault JB. KmL: Non-Parametric Algorithm for Clustering Longitudinal Data [Internet]. Version 2.4.6. Paris: [publisher unknown]; 2023 [cited 2023 Mar 06]. Available from: http://christophe.genolini.free.fr/kml/

Genolini C, Falissard B. KmL: K-means for longitudinal data. Comput Stat. 2010;25(2):317-28.

Goddard J, Tavakoli M, Wilson JO. Determinants of profitability in European manufacturing and services: evidence from a dynamic panel model. Appl Financial Econ. 2005;15(18):1269-82.

Gschwandtner A, Hirsch S. What drives firm profitability?: a comparison of the US and EU food processing industry. Manch Sch. 2018;86(3):390416.

Guiso L, Rustichini A. Understanding the size and profitability of firms: the role of a biological factor. Research in Economics. 2018;72(1):65-85.

Hansen GS, Wernerfelt B. Determinants of firm performance: the relative importance of economic and organizational factors. Strateg Manag J. 1989;10(5):399-411.

James G, Witten D, Hastie T, Tibshirani R. An introduction to statistical learning: with applications in R. New York: Springer; 2013. 612p.

Kammoun S, Alcouffe A. Enfoque económico de las competencias de la firma: hacia una síntesis de las teorías neoinstitucionales y evolucionistas. Boletín Cinterfor. 2003;(154):35-66.

Kuntluru S, Muppani VR, Khan MAA. Financial performance of foreign and domestic owned companies in India. Asia Pac Bus Rev. 2008;9(1):28-54.

Kuster C, Álvarez J, Lezcano M, Álvarez-Vaz R. Desempeño económico de las empresas agropecuarias uruguayas: estudio sobre su evolución a través de la técnica de clústers longitudinales a partir de datos contables [Internet]. Montevideo: Universidad de la República; 2021 [cited 2023 Mar 06]. 45p. (Serie documentos de trabajo; 10/21). Available from: https://zenodo.org/record/7150503#.Y0A_d3bMI2z

Laitinen EK. Extension of break-even analysis for payment default prediction: evidence from small firms. Invest Manag Financ Innov. 2011;8(4):96108.

Melgarejo Z, Vera M, Mora E. Diferencias de desempeño empresarial de pequeñas y medianas empresas clasificadas según la estructura de la propiedad del capital, caso colombiano. Suma de Negocios. 2014;5(12):76-84.

Mijić K, Jakšić D. The determinants of agricultural industry profitability: evidence from Southeast Europe. Custos e Agronegocio. 2017;13(1):154-73.

Ministerio de Economía y Finanzas, DGI (UY). Programa de ayuda Sigma: Formulario 1006 [Internet]. Versión 03. Montevideo: MEF; 2013 [cited 2023 Mar 06]. Available from: https://bit.ly/3kSGhWt.

Pascale R. Decisiones financieras. 3a ed. Buenos Aires: Ediciones Macchi; 1998. 810p.

Pascale R. Vinculación entre tamaño y rentabilidad: evidencia empírica en las empresas industriales manufactureras en Uruguay. Rev investig modelos financ. 2017;2(2):39-54.

R Core Team. R: a language and environment for statistical computing [Internet]. Vienna: R Foundation for Statistical Computing; 2015 [cited 2023 Mar 06]. Available from: https://www.R-project.org/.

Slater SF, Olson EM. A fresh look at industry and market analysis. Bus Horiz. 2002;45(1):15-22.

Tong Y, Saladrigues R. The predictability of financial, accounting-based, and industrial factors on the success of newly incorporated Spanish firms. Intangible Capital. 2018;14(1):127-45.

Vazquez M, Irimia A, Blanco A. La metodología de los Rough Sets como técnica de preprocesamiento de datos: una aplicación a las quiebras de microempresas familiares. Rect@. 2015,16(1):1-12.

Winter SG. Understanding dynamic capabilities. Strateg Manag J. 2003,24(10):991-5.

Yardin A. El análisis marginal. Buenos Aires: Editorial Osmar Buyatti; 2019. 429p.

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Agrociencia Uruguay

This work is licensed under a Creative Commons Attribution 4.0 International License.

| Article metrics | |

|---|---|

| Abstract views | |

| Galley vies | |

| PDF Views | |

| HTML views | |

| Other views | |